Why Law Enforcement Needs Smarter Financial Crime Software

Introduction to Malware Binary Triage (IMBT) Course

Looking to level up your skills? Get 10% off using coupon code: MWNEWS10 for any flavor.

Enroll Now and Save 10%: Coupon Code MWNEWS10

Note: Affiliate link – your enrollment helps support this platform at no extra cost to you.

In today’s digital and hyperconnected world, financial crime is evolving at an unprecedented pace. From global money laundering operations to multi-layered fraud networks, criminal enterprises are using advanced technologies to outpace traditional investigative methods. For law enforcement agencies, staying ahead requires more than expertise and intuition, it demands purpose-built financial crime software, powered by AI.

Modern investigations must parse massive volumes of both structured and unstructured data, detect hidden relationships, and enable rapid decision-making under pressure. This is where advanced financial crime software becomes a mission-critical asset.

The Evolving Tactics of Criminal and Terrorist Financing

Bad actors, including organized crime networks and terrorist groups, are exploiting increasingly complex financial systems to fund illicit activities and evade detection. Major drug cartels, for instance, operate elaborate money laundering schemes involving shell companies, trade-based laundering, and underground banking networks to legitimize profits from narcotics trafficking. In a notable 2024 case, a federal indictment charged Los Angeles-based associates of Mexico’s Sinaloa drug cartel with conspiring with money-laundering groups linked to Chinese underground banking to launder over $50 million in drug trafficking proceeds.

Another alarming trend is the rising use of cryptocurrencies by criminal and terrorist organizations to bypass traditional financial oversight. For example, in 2024, the U.S. Department of Justice seized over $200,000 in crypto assets tied to Hamas, which had used digital currencies to raise funds for terrorist operations. Unlike bank transfers, which are regulated and traceable, cryptocurrencies offer anonymity and decentralization, making it much harder for law enforcement and financial intelligence units (FIUs) to follow the money trail.

An additional tactic exploited by criminal and terrorist networks is the hawala system—an informal money transfer method that operates outside conventional banking channels. Based on personal trust rather than institutional oversight, hawala facilitates discreet, cross-border movement of funds with little to no paper trail, making it extremely challenging for law enforcement to trace illicit financial transactions. Hawala is particularly attractive for bad actors seeking to finance operations while eluding regulatory scrutiny and law enforcement efforts.

These complex schemes underscore the growing necessity for advanced financial crime software that can detect, analyze and connect seemingly unrelated data points across borders, entities and platforms. For law enforcement agencies, the right technology is not just a tool, it’s a strategic advantage in the fight against modern financial crime.

The Expanding Scope of Financial Crime

Financial crime encompasses a wide array of offenses: money laundering, fraud, embezzlement, extortion, insider trading and terrorist financing, to name a few. While the motives are familiar—power and profit—the methods are increasingly complex and transnational.

Traditional case-by-case analysis is no match for layered shell corporations, anonymized crypto transactions and dark web marketplaces. Law enforcement agencies and FIUs need financial crime detection software that can uncover and link criminal patterns buried deep within diverse, massive datasets.

The challenge? Connecting the dots across an expansive, disjointed web of financial data. Financial crimes rarely operate in silos. Instead, they involve sprawling networks of individuals, accounts, transactions and front companies that cross jurisdictions and legal frameworks.

From Data Overload to Contextual Intelligence

Effective financial crime investigations rely on more than isolated alerts; they require context. Advanced platforms now use entity resolution, network generation and context-driven analytics to build dynamic, real-world relationship graphs. These graphs connect suspects, accounts, companies, IP addresses and locations, helping investigators uncover criminal ecosystems—not just individual incidents.

Financial Crime Risk Management for Law Enforcement

Managing financial crime isn’t just about reacting to red flags, it’s about proactive risk mitigation. With the right financial crime software, law enforcement can:

- Uncover the financial infrastructure supporting organized crime and terrorism

- Disrupt fraud and money laundering schemes

- Focus resources on at-risk sectors and geographies

- Collaborate and share information more effectively with government agencies, financial institutions and international partners

Best-in-class financial crime risk management platforms go beyond traditional detection tools. They offer law enforcement agencies a unified, flexible framework that supports custom rules, advanced anomaly detection and in-depth investigations—enabling faster decisions, sharper focus and greater control in the face of complex financial threats.

Real-World Use Cases

Financial crime software is redefining how law enforcement agencies investigate and disrupt illicit activity. By combining real-time data analysis, AI-powered insights and dynamic visualizations, these platforms enable faster, more targeted investigations across a range of investigative use cases:

- Fraud: Uncover and investigate credit card fraud, insurance scams and procurement abuse, based on pattern recognition and behavioral analytics.

- Money Laundering: Follow the movement of illicit funds through complex financial transactions, crypto wallets, mobile payment apps and international transfers, using advanced anti-money laundering tools.

- Cybercrime: Trace ransomware payments, follow the digital trails of extortionists and link threat actors across platforms.

- Terrorist Financing: Identify and map networks of donors, crowdfunding campaigns and suspicious remittances that may be channeling funds toward extremist activities.

How to Choose Financial Crime Software for Law Enforcement

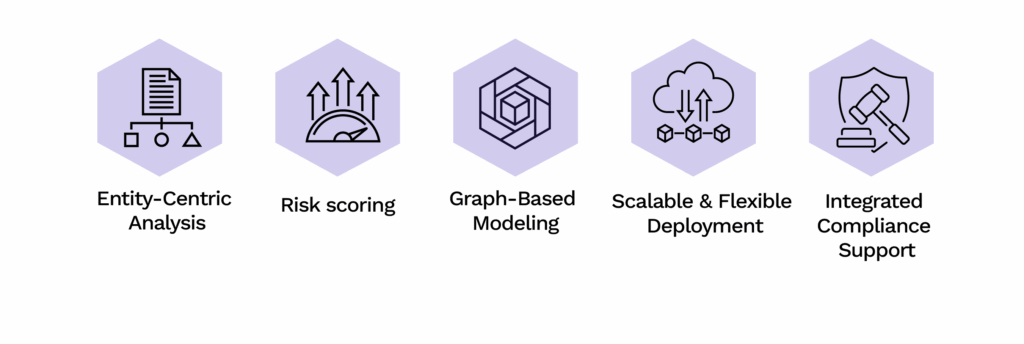

Choosing the right financial crime software is a strategic decision that can significantly impact the effectiveness of investigations. To stay ahead of sophisticated financial crime schemes, agencies should choose platforms with the following essential capabilities:

- Entity-Centric Analysis: The ability to build intelligence around people, organizations and networks—not just financial transactions

- Graph-Based Modeling: Essential for uncovering indirect and non-obvious links between behaviors and entities, such as suspicious individuals, institutions, devices, geographical locations and more

- Risk Scoring: The software must detect, score and surface risks as they unfold

- Scalability and Deployment Flexibility: Whether on-premises or in secure cloud environments, the software should support the needs of law enforcement agencies

- Integrated Compliance Support: Tools that help meet regulatory obligations while preserving investigative workflows

In an era where financial crime is faster, smarter and more elusive than ever, choosing the right software is essential to disrupting criminal operations effectively.

The Role of NEXYTE: Decision Intelligence in Action

NEXYTE, Cognyte’s decision intelligence platform goes beyond standard financial crime software and is designed to empower law enforcement in even the most complex financial investigations.

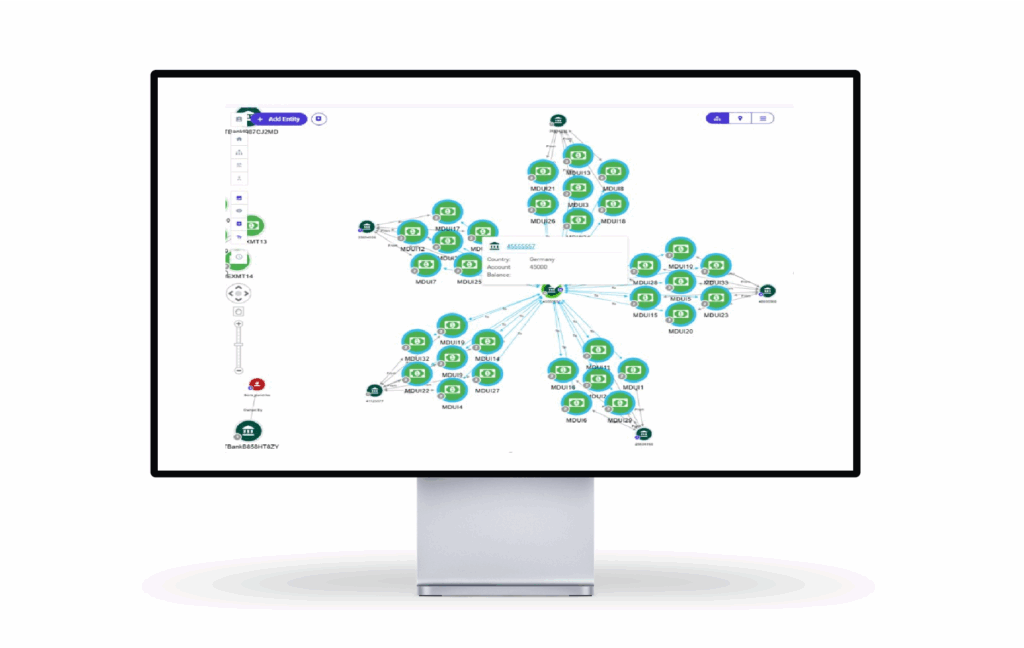

At its core, NEXYTE combines financial crime software with multi-source intelligence, advanced analytics and powerful visualization tools. It enables investigators to carry out intelligence-led investigations and uncover the full scope of criminal networks quickly, accurately and at scale.

With NEXYTE, agencies gain access to:

- Unified investigative workspace for financial crime analysis, based on advanced data fusion of structured and unstructured data

- Dynamic network mapping through intuitive link and graph visualizations for tracing criminal activity across borders and jurisdictions

- AI-powered insights for faster detection and prioritization of suspicious activities

- Embedded compliance tools that support financial crime compliance and regulatory alignment

This holistic view is critical. When investigators see how accounts, assets, communications and identities intersect across borders and platforms, they can act with clarity and confidence.

Link analysis visualization showing illicit money transfers

Link analysis visualization showing illicit money transfersTurning Data into Decisions

At the end of the day, the value of any financial crime tool lies in its ability to drive results. NEXYTE goes beyond data aggregation to deliver actionable intelligence. It helps law enforcement move from “what happened?” to “what’s next?”—a critical leap in time-sensitive investigations.

While there may be free financial crime software or standalone fraud detection software solutions available, they often lack the depth, scalability and integration required for mission-critical operations. NEXYTE delivers a future-proof, AI-enhanced solution designed specifically for the high-stakes world of law enforcement.

Conclusion: A Smarter Way to Combat Financial Crime

Criminals and terrorists are getting smarter, but so is the technology designed to stop them. As law enforcement agencies confront increasingly complex financial crime networks, they need tools that don’t just keep up with crime, but allow them to stay ahead. Capabilities such as AI for fraud detection, graph-based modeling and advanced analytics equip agencies with the tools to proactively detect, prevent and disrupt financial crime.

In a world where every second counts and every transaction matters, intelligence alone isn’t enough, it must translate into decisive action.

Discover how NEXYTE can transform your financial investigations

The post Why Law Enforcement Needs Smarter Financial Crime Software appeared first on Cognyte.

Article Link: Why Law Enforcement Needs Smarter Financial Crime Software | Cognyte

1 post - 1 participant

Malware Analysis, News and Indicators - Latest topics